Business Insurance in and around Lincolnwood

Get your Lincolnwood business covered, right here!

Almost 100 years of helping small businesses

Help Protect Your Business With State Farm.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all alone. As someone who also runs a business, State Farm agent Patrick Zeunik is not unaware of the work that it takes and would love to help lift some of the burden. This is insurance you'll definitely want to explore.

Get your Lincolnwood business covered, right here!

Almost 100 years of helping small businesses

Get Down To Business With State Farm

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is shut down. It not only protects your salary, but also helps with regular payroll costs. You can also include liability, which is important coverage protecting your financial assets in the event of a claim or judgment against you by a visitor.

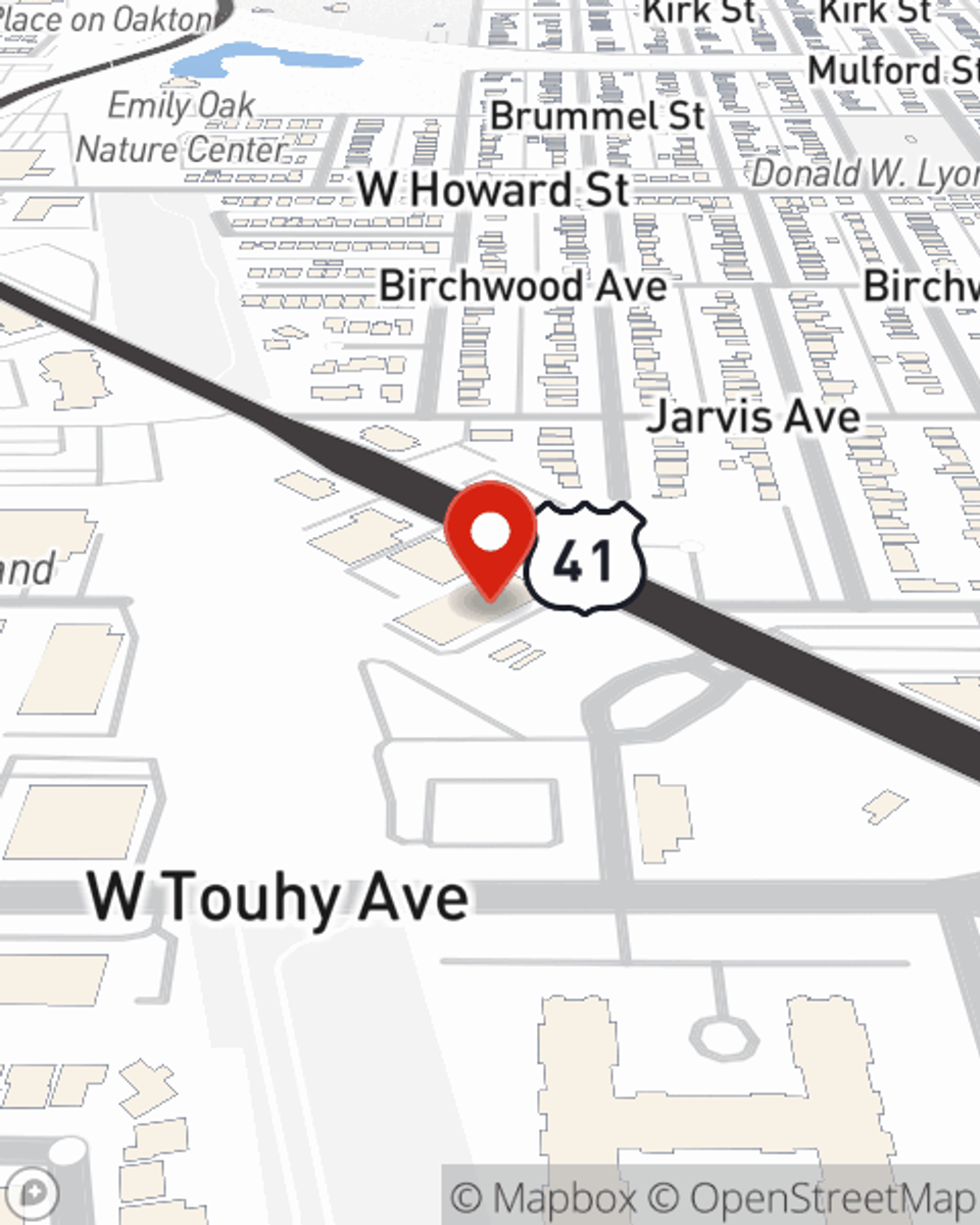

Visit State Farm agent Patrick Zeunik today to see how one of the leading providers of small business insurance can ease your business worries here in Lincolnwood, IL.

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.

Patrick Zeunik

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Consider a Simplified Employee Pension plan for your small business

Consider a Simplified Employee Pension plan for your small business

Simplified Employee Pension IRA (SEP IRA) plans are employee IRAs funded by tax-deductible contributions from small business employers.